The Most Powerful Factoring Software for Modern Factoring Companies

Factor Avenue is your all-in one invoice factoring software that automates onboarding, scoring, and funding, so you can run faster, scale smarter, and serve clients like an industry leader. With secure online invoice factoring, smart risk tools, and a seamless web-based lending system, we help you stay ahead in the factoring business.

Invoices Processed Daily

Trusted platform built for scale and speed.

Uptime

Secure, cloud-based infrastructure

Faster Funding

verification and funding turnaround with automation

Enterprise-Grade Security

Built by Factoring Experts. Trusted by Growth-Driven Fintechs.

Factor Avenue is a comprehensive, intuitive factoring software backed by 13 years of industry excellence and expertise. Designed to simplify operations and improve performance for businesses managing invoices across various industries, it brings together everything you need in one powerful platform. With smart features for digital onboarding, risk scoring, funding, and collections, our software for factoring reduces manual work and cuts training time for your staff. Whether you’re scaling invoice factoring services or streamlining internal workflows, Factor Avenue gives you the control, speed, and ease needed to drive growth in a competitive market.

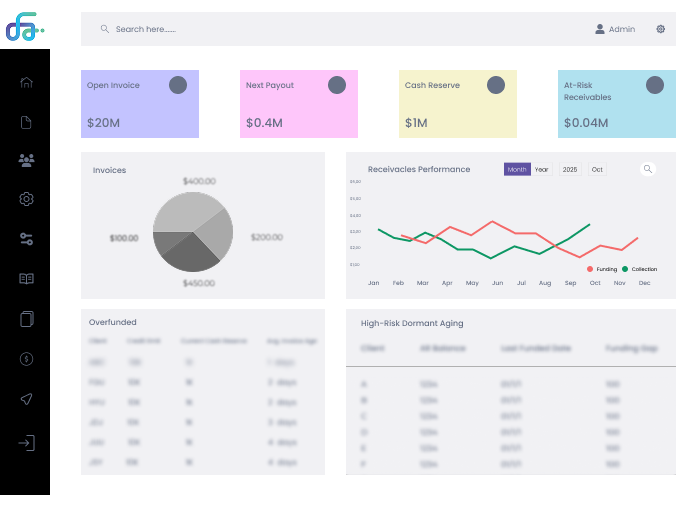

Everything You Need to Run a Smarter Factoring Operation

Factor Avenue is an all-in-one factoring software that helps factoring companies manage onboarding, invoice verification, risk control, funding, and collections from a single platform. It replaces manual processes with automation, improves accuracy, and gives real-time visibility across the entire factoring lifecycle.

Automate client onboarding with KYB/KYC checks, structured document workflows, compliance reminders, and real-time client monitoring. Bulk uploads, multi-currency support, and dynamic rules help factoring teams manage clients efficiently from a single dashboard.

Create invoices manually, in bulk, or through API connections. The system verifies invoices using duplicate detection, authenticity checks, fraud scoring, and approval workflows, ensuring only clean and verified invoices move forward.

Monitor risk with real-time exposure tracking, aging analysis, utilization limits, and historical payment behavior. Cross-client verification and predictive risk indicators help factors make safer funding decisions.

Configure advance rates, automate full or partial funding, deduct fees upfront, and process batch payments. Holiday rules and instant funding notifications ensure accurate and timely disbursements.

Manage collections with support for partial and full payments, dispute handling, multi-currency recovery, and automatic cash matching. Structured workflows and reminders help speed up settlements.

Automate reserve creation, funding, and release with a dedicated reserve ledger for each client. This ensures accurate settlements and full transparency across reserve movements.

Set automated fee rules, manage taxes, and calculate interest accurately. Support floating contracts, IBOR-linked rates, and country-specific pricing structures without manual calculations.

Provide role-based portals for factors, clients, and debtors. Users can submit invoices, track approvals, monitor funding, and manage corrections with clear visibility at every stage.

Access real-time reports for funding, aging, collections, exposure, and historical behavior. Export audit-ready data and monitor performance through structured dashboards.

Connect with the Tools You Already Use

How Factor Avenue Works for Factor Companies

Factor Avenue automates and streamlines every step of the factoring process, from onboarding to collections. Here’s how our system helps factoring companies work faster, reduce risk, and fund clients confidently.

Digital Onboarding &

Client Setup

Quickly onboard new clients with automated KYB/KYC checks, document uploads, and compliance workflows. Customize funding parameters and advance rates based on your business needs.

Invoice Submission & Smart Verification

Clients upload invoices through a secure portal or API. Factor Avenue verifies invoices automatically using validation rules, checks for duplicates, and ensures accuracy before processing

Risk Scoring & Credit Decisioning

Analytics & Growth Reporting

Payment Tracking & Collections Management

Automated Funding & Advance Management

Industries We Serve

Factor Avenue supports businesses across major invoice-driven industries where fast cash flow, accurate operations, and reliable funding matter the most. Our factoring software adapts to different workflows, funding needs, and debtor structures—making it a powerful choice for companies of all sizes.

Manufacturing

Support high-volume invoice cycles with automated verification, faster approvals, and better debtor tracking to keep production running smoothly.

Transport & Logistics

Handle POD delays, frequent loads, fleet payments, and variable invoices with automated checks, digital submissions, and real-time status updates.

Wholesale & Distribution

Manage large B2B orders, long payment terms, and multiple debtor accounts with smart workflows built for accuracy and control.

Professional Services

Manage large B2B orders, long payment terms, and multiple debtor accounts with smart workflows built for accuracy and control.

Types of Factoring We Support

Factor Avenue is built to support the most important debtor finance models used by modern factoring companies. Whether you operate simple or complex funding structures, our invoice factoring software adapts to your needs with accuracy, automation, and full visibility.

Recourse Factoring

Non-Recourse Factoring

Fund confidently with built-in risk scoring, fraud detection, and real-time credit insights. Our software helps you evaluate debtor strength and reduce default risks while offering fully protected, non-recourse financing.

Invoice Discounting

Support confidential funding programs with automated ledger updates, borrowing base calculations, and secure client access. Maintain accuracy while giving businesses flexible access to working capital.

Reverse Factoring

Support supplier-focused funding where buyers approve invoices upfront. Automate verification, improve cash flow for suppliers, and strengthen buyer–supplier relationships.

Export Factoring

Manage cross-border invoices with support for multiple currencies, foreign debtors, and global payment cycles. Reduce international risk with clean tracking and automated checks.

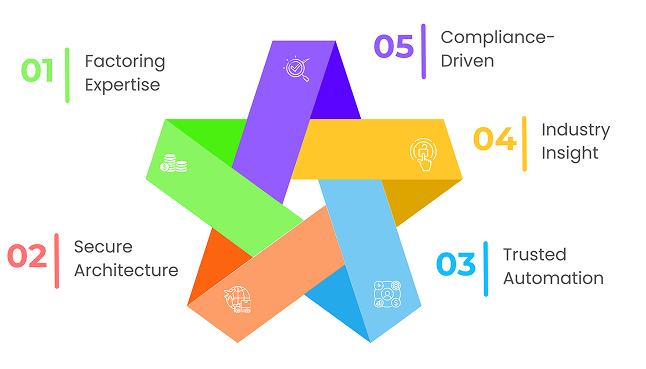

What Makes Factor Avenue Different

Factor Avenue is a comprehensive, intuitive factoring software backed by 13 years of industry excellence and expertise. Designed to simplify operations and improve performance for businesses managing invoices across various industries, it brings together everything you need in one powerful platform.

Intelligent Portals for Factors, Clients & Debtors

Each participant gets a clean, simple portal that streamlines uploads, verifications, and approvals, improving communication and ensuring faster movement across every step of the factoring process.

Built to Handle High-Volume Factoring Operations

The platform manages large workloads, bulk invoice submissions, and multi-branch operations smoothly, helping factoring teams scale without delays, technical limitations, or performance issues.

Full Transparency Across the Entire Factoring Lifecycle

Real-time dashboards show exposure, aging, reserves, disputes, and payments, giving factoring teams the clarity they need to make faster decisions and maintain full operational control.

Cloud-Based, Secure, and Always Accessible

Factor Avenue runs on a secure, cloud-based system with SOC2-ready controls, providing safe, reliable access from anywhere without server maintenance, downtime, or technical interruptions.

24/7 Support, Training & Onboarding Assistance

Factoring teams receive round-the-clock support, guided onboarding, and continuous training, ensuring smooth adoption, quick issue resolution, and confidence at every stage of the workflow.

What Is the Cost of Factor Avenue?

The cost of Factor Avenue depends on your team size, invoice volume, and the features you need. Instead of fixed, rigid plans, we offer flexible pricing that adapts to your factoring workflow. You pay only for what you use, and every plan includes secure onboarding, automated verification, real-time dashboards, and 24/7 support—so your factoring operations stay fast, accurate, and scalable.