Invoice Factoring Software for Modern Factoring Companies

Factor Avenue is a self-built, AI-powered invoice factoring software that automates client onboarding, invoice verification, risk scoring, and funding. Built specifically for factoring companies, it replaces manual workflows with a secure, cloud-based platform—helping you fund faster, reduce risk, and scale operations with confidence.

Invoices Processed Daily

Trusted platform built for scale and speed.

Uptime

Secure, cloud-based infrastructure

Faster Funding

verification and funding turnaround with automation

Enterprise-Grade Security

SOC2, ISO 27001, and GDPR-compliant data protection.

Built by Factoring Experts. Designed for Factoring Teams.

Factor Avenue is built by teams with over a decade of experience designing and running enterprise-grade factoring systems. Our technology powers high-volume platforms that process 50,000+ invoices daily and support complex workflows across onboarding, risk, funding, reserves, and collections.

Unlike generic lending software, Factor Avenue is designed specifically for factoring companies. Every feature reflects real-world factoring operations, helping teams reduce manual effort, onboard faster, and manage risk with confidence as they scale.

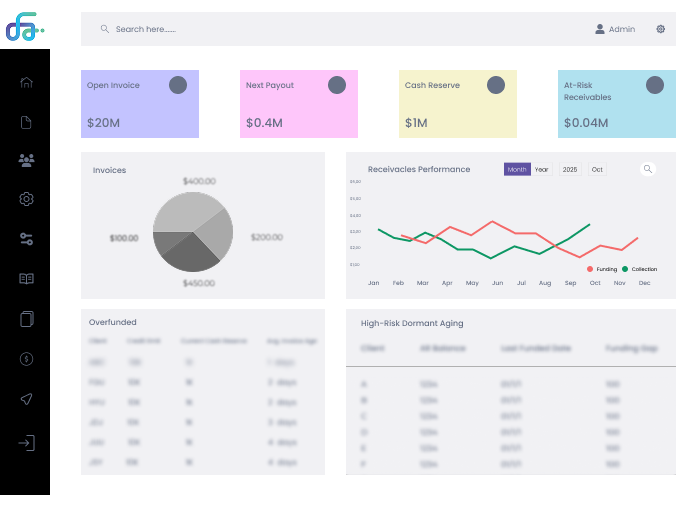

Everything You Need to Run a Smarter Factoring Operation

Factor Avenue is an all-in-one factoring software that helps factoring companies manage onboarding, invoice verification, risk control, funding, and collections from a single platform—reducing manual work while maintaining full operational visibility across the factoring lifecycle.

Digitize client and debtor onboarding with structured workflows, compliance document collection, bulk uploads, and multi-currency support—so every relationship is verified, compliant, and ready for funding from day one.

Submit and verify invoices through portals, bulk upload, or API. Built-in validation checks ensure only accurate, eligible invoices move forward for funding—reducing errors and delays.

Track exposure, limits, aging, and concentration in one view. Credit insights and historical payment data help teams make safer funding decisions with greater confidence.

Apply advance rates, fees, and disbursements consistently across invoices. Funding logic adapts to different clients, invoices, and factoring models without manual recalculation.

Manage reserves and settlements with clear client-level tracking. Transparent reserve handling supports recourse and export factoring workflows while protecting margins.

Monitor outstanding invoices, partial payments, disputes, and recoveries from a single dashboard—keeping collections organized and settlements accurate.

Configure fees, interest, and deductions based on client agreements and funding terms—ensuring accurate pricing without spreadsheet dependency.

Provide secure self-service access for invoice submission, funding status, and lifecycle tracking—reducing follow-ups and improving transparency.

Access funding, aging, exposure, and collection insights through audit-ready dashboards to support reviews, compliance, and decision-making.

Connect with accounting, banking, and credit systems using APIs and pre-built integrations—keeping data in sync across your existing tools.

Control access, approvals, and actions with role-based permissions and audit logs—supporting compliance and accountability across teams.

Manage invoices, approvals, funding status, and collections from anywhere with mobile access designed for factoring operations.

Connect with the Tools You Already Use

Factor Avenue integrates with your accounting, banking, and payment systems through pre-built integrations and an open API—keeping data in sync.

Connect with QuickBooks, Xero, Stripe, Plaid, and more, or build custom integrations as needed.

How Factor Avenue Works for Factoring Companies

From onboarding to funding in days, not weeks.

Factor Avenue streamlines every step of the factoring process—helping factoring companies reduce risk, improve speed, and fund clients with confidence.

Digital Onboarding & Client Setup

Onboard new clients with guided KYB/KYC checks, document uploads, and compliance workflows. Funding parameters and advance rates are configured upfront for faster approvals.

Invoice Submission & Smart Verification

Clients submit invoices through secure portals or APIs. Invoices are validated for accuracy and eligibility before moving forward—reducing errors and delays.

Risk Scoring & Credit Decisioning

Exposure, limits, concentration, and payment behavior are evaluated in one view to support faster, policy-aligned funding decisions.

Automated Funding & Advance Management

Approved invoices are funded using predefined advance rates, reserves, and disbursement rules—ensuring accuracy and transparency.

Payment Tracking & Collections Management

Track outstanding invoices, aging, disputes, and payments from a single dashboard. Collections stay organized and fully traceable.

Analytics & Growth Reporting

Access real-time dashboards covering funding, exposure, and client performance to guide operational decisions and support growth.

Digital Onboarding & Client Setup

Onboard new clients with guided KYB/KYC checks, document uploads, and compliance workflows. Funding parameters and advance rates are configured upfront for faster approvals.

Invoice Submission & Smart Verification

Clients submit invoices through secure portals or APIs. Invoices are validated for accuracy and eligibility before moving forward—reducing errors and delays.

Risk Scoring & Credit Decisioning

Exposure, limits, concentration, and payment behavior are evaluated in one view to support faster, policy-aligned funding decisions.

04

Automated Funding & Advance Management

Approved invoices are funded using predefined advance rates, reserves, and disbursement rules—ensuring accuracy and transparency.

05

Payment Tracking & Collections Management

Track outstanding invoices, aging, disputes, and payments from a single dashboard. Collections stay organized and fully traceable.

Analytics & Growth Reporting

Access real-time dashboards covering funding, exposure, and client performance to guide operational decisions and support growth.

06

Industries We Serve

Purpose-built workflows for invoice-driven and receivables-based industries.

Factor Avenue supports factoring companies operating across industries where delayed payments, complex billing, and risk control directly impact cash flow. Each industry is supported with workflows designed for its billing structure, debtor behavior, and funding model.

Manufacturing

Control PO-linked invoices, long payment terms, deductions, and distributor-led settlements across high-volume operations.

Wholesale & Distribution

Manage high-volume B2B invoices, buyer credit risk, short-pays, deductions, and multi-location distribution networks.

Professional Services

Support milestone, retainer, and time-based billing with controlled client exposure and delayed approvals.

Agriculture

Manage seasonal invoices, commodity-based payment delays, and buyer exposure across agri-trade operations.

Supply Chain Financing

Support buyer-led, multi-supplier funding models with controlled exposure, approvals, and settlement visibility.

Healthcare

Fund insurance-backed receivables while handling long reimbursement cycles, payer rules, compliance, and sensitive documentation.

Funeral Homes

Manage Assignment of Benefits (AOB) claims, insurer delays, sensitive records, and audit-ready funding workflows.

Payroll Funding

Ensure on-time payroll funding despite weekly payouts, delayed client payments, and high-frequency timesheets.

Construction

Handle progress billing, milestone-based invoices, retainage, approvals, and contractor payment delays.

Import & Export

Fund cross-border invoices with multi-currency handling, country risk control, trade documentation, and longer settlement cycles.

Purchase Order

Fund orders before delivery by validating POs, suppliers, buyer commitments, and funding eligibility.

Oil Field

Support project-based invoicing tied to field documentation, operator approvals, and multi-region oilfield operations.

Built for Factoring. Customized Around Your Needs.

No two factoring companies operate the same way. Factor Avenue provides targeted customizations aligned to your factoring model, client structures, credit policies, and operational requirements.

From onboarding and verification to funding rules, approval logic, and exposure controls, the platform is customized to reflect how your business actually operates—without forcing rigid, pre-set workflows.

Every industry and factoring structure brings different risk frameworks and process demands. We tailor the system to support your operational realities while maintaining platform stability, performance, and long-term scalability.

Enterprise capability does not require unnecessary complexity or inflated costs. Factor Avenue delivers meaningful customization within a scalable architecture—so you gain flexibility and control without excessive overhead.

Types of Factoring We Support

Factor Avenue supports all major debtor finance and receivables funding models used by modern factoring companies. Whether your operations are domestic, international, recourse-based, or buyer-led, the platform adapts to your structure with control, accuracy, and visibility.

Recourse Factoring

Manage client responsibility, reserves, exposure, and settlements with clear rules and full audit visibility.

Non-Recourse Factoring

Fund invoices with greater confidence using debtor risk insights, credit controls, and default protection workflows.

Invoice Discounting

Run confidential funding programs with clean ledgers, borrowing base visibility, and controlled client access.

Reverse Factoring

Support buyer-approved invoice funding that improves supplier cash flow while maintaining funding discipline.

Export Factoring

Fund international invoices with multi-currency handling, foreign debtor tracking, and cross-border settlement visibility.

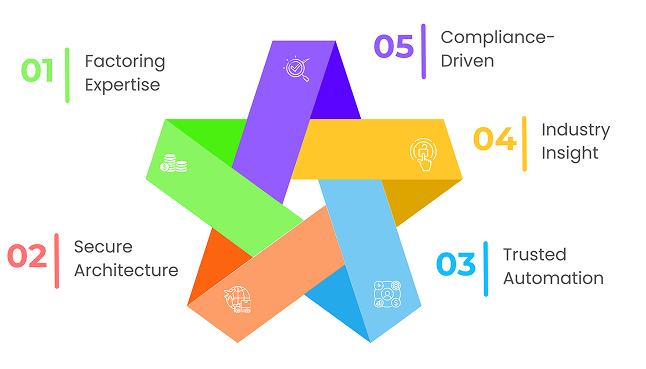

What Makes Factor Avenue Different

A self-built, AI-powered factoring platform for modern factoring companies, combining automation, proven scale, and secure infrastructure to help teams fund faster and reduce risk. Trusted by high-volume factoring teams.

Built Specifically for Factoring

Designed from the ground up to support reserves, recourse logic, debtor exposure, and collections—without adapting generic lending software or relying on workarounds common in loan-based systems.

Proven at Enterprise Scale

Backed by 18+ years of factoring technology experience, the platform supports sustained high-volume invoice processing with consistent performance and 99.9% uptime.

End-to-End Operational Control

Unified dashboards provide real-time visibility into exposure, aging, reserves, disputes, funding, and payments—enabling faster, policy-aligned decisions across the factoring lifecycle.

Purpose-Built Portals

Dedicated portals for factors, clients, and debtors streamline submissions, approvals, and tracking—reducing back-and-forth and accelerating approvals.

Configurable by Industry

As industries follow different workflows, Factor Avenue offers industry-relevant customizations to align onboarding, funding, and controls with your operations.

Security, Compliance & Reliability

SOC2-ready controls, encryption, audit logs, and secure cloud infrastructure protect financial, client, and debtor data at all times.

Support from Factoring Specialists

Guided onboarding, continuous training, and 24/7 support from professionals who understand factoring operations—not generic SaaS support teams.

Trusted Across the Global Factoring Ecosystem

Factor Avenue powers operations for 200+ factoring companies and is trusted by 5,000+ active business clients across invoice-driven industries worldwide.

What Is the Cost of Factor Avenue?

Factor Avenue uses flexible, usage-based pricing designed to scale with your factoring operations. Pricing depends on your team size, invoice volume, and the features you need—so you pay only for what you use.

Every plan includes secure onboarding, automated verification, real-time dashboards, and 24/7 support to keep operations fast, accurate, and scalable.

Pricing is based on:

- Number of users

- Enabled modules and factoring models

No minimum contract. Onboarding included. Pricing scales as you grow.

Transform your factoring operations with

intelligent automation.

Discover how our platform can optimize your invoice management, reduce risk, and accelerate cash flow.